我是廣告 請繼續往下閱讀

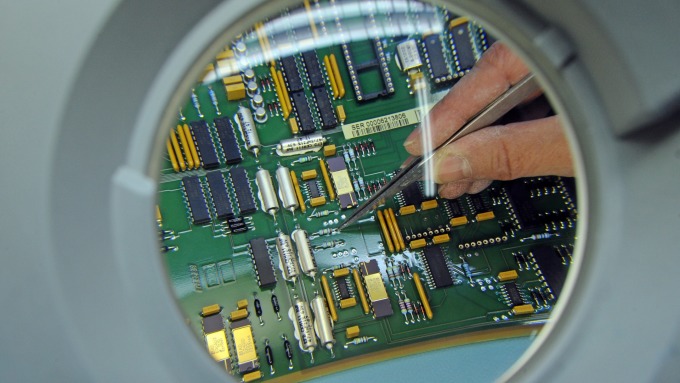

The application of Tripod’s PCB mainly focuses on memory modules, hard drives, NB, photovoltaic panels, smart phones and servers, automotive panels, etc. The company is also a supplier of Xiaomi’s smart phones.

Currently, in all PCB plants in China, Tripod’s output value is second only to Zhen Ding(4958-TW).

Tripod’s 4Q18 revenue was NTD13.12bn (-10.94% QoQ, +4.1% YoY), second in its history. Its FY18 revenue was NTD52.105bn (+13.72% YoY), setting a new record high.

Large PCB companies announced their FY19 capital expenditure estimations gradually. Unimicron (3037-TW) estimated that its FY19 capital expenditure may reach NTD8bn. Zhen Ding estimated that its FY19 capital expenditure may be over NTD10bn, comparing its FY18 capital expenditure of NTD10bn.

Zhen Ding is largest PCB manufacturer in China. Its plant at Huai'an mainly produces PCB, FPCB, and automotive related. Its plant at Qinhuangdao is mostly producing FPCB and SLP. In response to market demand, construction commencement of Huai'an Plant Phase II started in Nov 17th and mass production is expected to start in 2H19. The new capacity will focus on FPCB as well.

更多精彩內容請至 《鉅亨網》 連結>>